Investing for a higher pension

- Loss of value right before retirement: what is happening

- Pension investment for the long term

- How we limit the risks

- Right before retirement: rising interest rates, falling share prices and vice versa

Are you accruing an investment-linked pension at Nationale-Nederlanden via your current or former employer? In that case, the amount of your future pension benefits is not set in stone. Below, you can read more about investing for the long term and how we minimise the risks of your investment-linked pension.

Pension investment for the long term

Pension investment means investing money for the long term. During that long period, there will inevitably be times that share prices go down sharply. We know that this happens from time to time, but of course we do not know when exactly. Many historical analyses have revealed that, in the long run, investing yielded better results in the past than saving, for example.

Historical price trends show that price drops were eventually followed by price increases in the past. Importantly, therefore, our eyes should always be firmly fixed on the long term ('the investment horizon') when investing for retirement.

Looking further ahead can help bring into focus that strong price fluctuations in the short term need not necessarily be problematic for long-term performance. It is a well-known fact that panic buying and selling can turn out very badly in periods of price drops followed by recovery.

In fact, major losses are frequently the result, as panic sellers tend to miss out on subsequent price increases. For example, a person who stopped investing after the credit crunch missed out on a 12% return year on year.

While we realise that Nationale-Nederlanden cannot give a price guarantee, we do apply an investment strategy for your pension investments that focuses on the long term.

How we limit the risks

Diversified investment

A key principle of investing your pension money is to spread your investments. We invest across the world in countless companies, sectors and asset classes (such as shares and bonds). This way, a price drop or bankruptcy of any one company will not severely impact the value of your investments.

In addition, not every type of investment is equally hard hit by current turmoil. In short, our diversified investment of your pension money limits your risk.

Investing according to the lifecycle method

We invest your pension money according to the lifecycle method. It means that we will invest in riskier investments for you when you are younger. There will then be sufficient time to make up for interim price drops once the economy picks up again. As your retirement age approaches, we will gradually reduce the risk for you.

To this end, the investments consist of several parts:

After a certain age, we will gradually reduce the investments in return funds and increase the investments in matching funds.

The matching funds provide greater assurance as to the level of your pension. On your retirement date, you will use your pension capital to purchase pension benefits. The benefit amount that your pension capital can buy you depends on the market rate at that time.

A low market rate means that you will need more capital to buy the same amount in pension benefits compared with a situation of high interest rates. The matching funds reduce this interest rate risk as investments in these funds go up in value when interest rates fall.

The reverse is also true: when interest rates go up, the value of the investments goes down. However, a higher interest rate means that you will need less money to buy equally high pension benefits.

How we reduce the investments depends on your pension product. In many cases we will invest more in so-called matching funds. At what age we will start doing so depends on your risk profile.

Right before retirement: rising interest rates, falling share prices and vice versa

As your retirement date approaches, your interest in the amount of pension you can look forward to grows. The value accrued with the investments is then checked more often. Any severe drop in value might come as a great shock. An understandable reaction, but not altogether justified. Let us explain what is happening here.

The amount of your pension is for a large part determined by the interest rate. If interest rates are high, you can buy more pension with the same amount of capital than is the case when interest rates are low. But the exact interest rate cannot be predicted.

Lifecycle investing provides more assurance as to the amount of pension expected, especially as the retirement age approaches. According to this method, we increase our investments in funds that run counter to interest rate developments. When interest rates fall, prices rise. And when interest rates rise, prices fall. This is because a rising interest rate reduces the purchase price of pensions. Below is a step-by-step explanation:

Falling interest rate

-

1The interest rate goes down

-

2The interest rate for purchasing a pension goes down

-

3Pensions become more expensive

-

4You need more pension capital for the same amount of pension

-

5Matching funds ensure that your pension capital goes up

-

6With the fall in interest rates and the matching funds, you can buy roughly the same amount of pension

Rising interest rate

-

1The interest rate goes up

-

2The interest rate for purchasing a pension goes up

-

3Pensions become cheaper

-

4You need less pension capital for the same amount of pension

-

5Matching funds ensure that your pension capital goes down

-

6With the rise in interest rates and the matching funds, you can buy roughly the same amount of pension

Investing in the matching funds creates maximum stability for your pension. That is what is important to us.

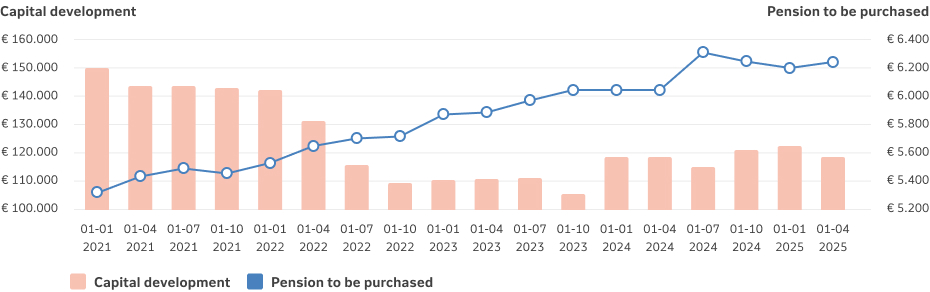

Sample calculation

The graph and table below show how the pension to be purchased (gross annual amount) develops in a period of rising interest rates and declining investment capital. This example applies to an ‘average Joe’ aged 67 with a partner who is three years younger than him. As you can see, the pension to be purchased remains level.

| Date (d-m-y) | Capital development | Gross pension to be purchased (annual amount) | 10-year yield |

| 01-01-2021 | € 150.000,00 | € 5.336,20 | -0,26% |

| 01-04-2021 | € 143.673,16 | € 5.434,45 | 0,08% |

| 01-07-2021 | € 143.581,54 | € 5.499,01 | 0,13% |

| 01-10-2021 | € 143.139,46 | € 5.459,11 | 0,15% |

| 01-01-2022 | € 142.399,62 | € 5.531,89 | 0,30% |

| 01-04-2022 | € 131.370,98 | € 5.653,65 | 1,30% |

| 01-07-2022 | € 116.010,74 | € 5.707,35 | 2,36% |

| 01-10-2022 | € 109.736,90 | € 5.725,58 | 3,18% |

| 01-01-2023 | € 110.159,82 | € 5.885,27 | 3,11% |

| 01-04-2023 | € 110.491,13 | € 5.879,28 | 3,01% |

| 01-07-2023 | € 111.002,56 | € 5.963,49 | 2,99% |

| 01-10-2023 | € 105.469,42 | € 6.056,76 | 3,50% |

| 01-01-2024 | € 118.906,38 | € 6.060,44 | 2,41% |

| 01-04-2024 | € 117.773,95 | € 6.072,57 | 2,57% |

| 01-07-2024 | € 115.476,63 | € 6.317,20 | 2,79% |

| 01-10-2024 | € 120.767,21 | € 6.261,00 | 2,37% |

| 01-01-2025 | € 122.632,95 | € 6.201,35 | 2,37% |

| 01-04-2025 | € 118.369,56 | € 6.259,79 | 2.67% |

Check your pension at mijn.nn

At mijn.nn you can see not only the value of your pension investments, but also your expected pension benefits. No matter whether interest rates rise or fall, your expected benefits will remain more or less the same. And that is what counts. Log in to mijn.nn, click on your pension product and go to your personal Future Income (Inkomen Later) pension environment.

Keeping a cool head in turbulent times!

In times of great turmoil, you are bound to feel the urge to act fast. But the principles we apply remain valid even in these times of uncertainty. Keeping a cool head in difficult times is the best we can do.

Service en Contact

We kunnen je op verschillende manieren helpen.

Wil je advies?

Met een onafhankelijk adviseur kijk je samen naar welk product bij je past.